Special journal is a specialized list of financial transaction records which list sales, purchase, cash and other particular transactions in separate journal entries. It should help them to audit any transactions quickly.

This separation is common for accountants in merchandising and manufacturing companies. By separating particular transactions, they can easily spot receivables, payable and inventory without looking them in a long transaction list if they are using a single general journal.

Here are three common special journals :

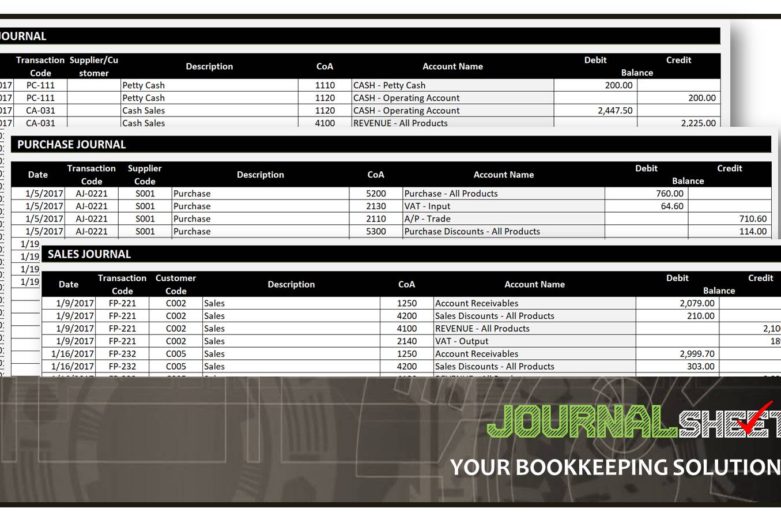

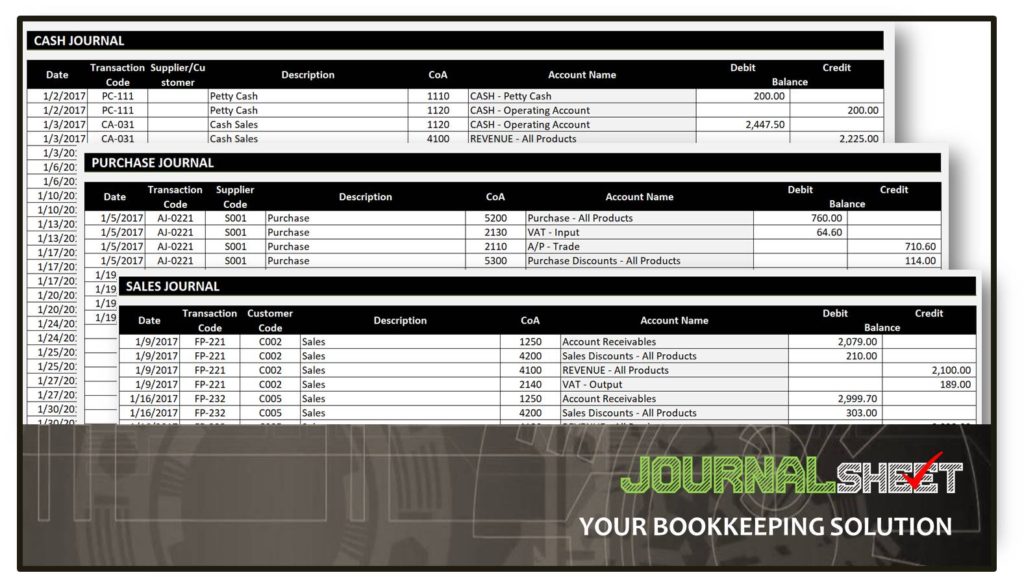

Cash Journal

Accountants use this journal to record all cash transactions.

All cash transactions? Yes.

Sales transaction with bank transfer method fall into this category. Payable and receivable payment also fall into this category.

Sales Journal

You record sales transactions with receivable transactions in this journal. Remember, only receivable. If sales payment is in cash, then you need to write it in Cash journal.

Can I write sales transactions with cash payment in this journal? Depends on the accounting application that you use. Please check its user guide before you input any sales transactions.

Purchase Journal

Purchase journal is basically similar with sales journal. Except, it is used to record purchase transactions with payable payment.

Three journals above are most common special journals you will find in any accounting application for merchandising or manufacturing companies. They usually have similar layouts with general journal. The difference only on its content for financial statements to pull and process its financial data.